Category: Listening Sessions, Personal Stories, Poverty News & Policy Updates, The Safety Net

September 21st, 2023

by Sabrina Hamm

“I never imagined the financial burden of leaving. Now [I] know why [women] may choose to instead go back. It’s been difficult… I was turne[d] down from a [well-paying] job [because] of my debt. Even though [it would] take about 3 paychecks to pay off and be debt free if I had been hired.” – A survivor in California

Financial insecurity is the number one obstacle to the long-term safety of survivors of intimate partner violence (IPV). In California, 40% of women will be subjected to IPV in their lifetime. That means we need to be doing everything we can to ensure that our laws prioritize financial security for survivors.

In 99% of IPV cases, survivors are subjected to economic abuse—a harm-doer exerting control over a survivor’s finances and access to resources. Examples include putting a survivor on a strict allowance, demanding receipts for all purchases, monitoring and depleting a survivor’s bank accounts, and even incurring debts in a survivor’s name without their knowledge or consent (known as “coerced and fraudulent debt”).

The consequences are devastating. Survivors are often left with hundreds of thousands of dollars in costs, no assets, no cash, no income, tens of thousands of dollars in unjust debt, damaged credit, and no support system.

“[The harm-doer] refused to work so that I would be financially supporting them even though I was not making enough income to afford our apartment…” – A survivor in California

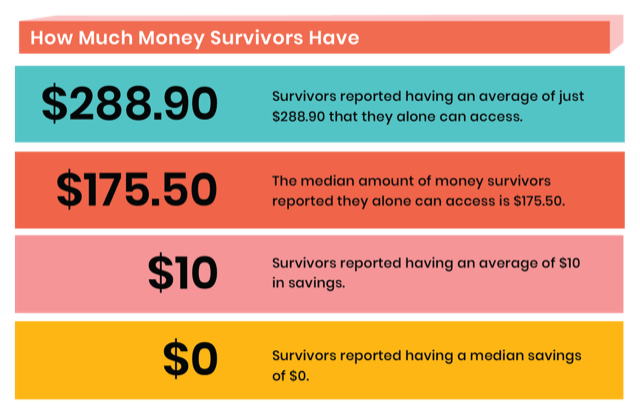

In a 2020 national survey of more than 2,100 survivors, FreeFrom—my organization with a mission to create pathways to long-term safety and financial security for survivors of IPV–found:

“At one point my abuser took my mail and I was not advised of my outstanding loans for school and I lost the ability to re-enroll[.] I [spent] a year paying loans on time to be able to qualify for a [FAFSA] which delayed my ability to finish school…” – A survivor in California

In order to fully support survivors there must be diversity in support, services, and resources across all sectors of society, including those provided by the California state government.

“I have called the police for my domestic abuse and assault from my husband who I filed for divorce from. And I pressed charges. During that time police made comments to me about what I did to provoke him and I didn’t feel safer with police there. I don’t trust police.” – A survivor in California

As part of expanding support for survivors, immediate crisis responses must not be limited to the police. More than 40% of survivors want to call a community crisis intervention team trained in de-escalation instead of police. The CRISES Act is a step in the right direction—it creates a grant program for community-based organizations to create emergency response pilots.

California has also made significant progress in establishing coerced and fraudulent debt protections. AB 2517, signed by the Governor in 2020, allows courts to find that specific debts were incurred as the result of domestic violence and without consent. The law will help free survivors from these unjust debts.

“[The harm-doer] forced me to use my bank account as hers… Tarnished my credit by opening joint accounts in my name without my consent, then demanding money that does not correspond to the cost of whatever she [was] asking for.” – A survivor in California

In 2021, AB 430 mandated that creditors, debt collectors, and debt buyers accept a Federal Trade Commission identity theft report as proof of identity theft related to a particular debt. It also clarifies that a police report can be used as evidence but is not required. This expansion of acceptable proof is critical, given that 68% of survivors do not feel safe getting and/or sharing a police report.

Lastly, SB 975, signed in 2022, will bring much-needed relief by allowing a survivor to show documentation that a debt was due to coercion. Once proven, the creditor (such as a credit card company) can no longer hold the survivor liable.

“I was not allowed to spend money. My money was deposited into a bank account that was in my name but only my partner had access to my banking card. I wasn’t allowed to go inside the bank [unless] he was there with me.” – A survivor in California

Banks and other financial institutions are in a unique position to prevent economic abuse and protect survivors’ money and assets. However, 74% of survivors said that they do not have a bank account that is protected from their harm-doer. In 2022, Asm. Timothy Grayson (D-Concord) introduced a bill that would create free online training for financial institutions on how to identify and respond to economic abuse. Unfortunately, the bill did not pass. Banks can equip themselves to protect survivors’ resources and assets—80% of survivors agree that training bank employees to detect, prevent, and respond to economic abuse would help survivors’ financial security.

AB 1082, introduced by Asm. Ash Kalra (D-San Jose), would prevent towing a car when someone has less than five unpaid parking tickets. It would also improve payment plan options. For a domestic abuse survivor, a tow can mean a loss of their only means of safety. This law would allow survivors to keep their vehicle as they pay their tickets over time and ensure their safety.

Lastly, a state-wide unrestricted cash grant program, similar to the many guaranteed income pilot programs across the nation, would give survivors the flexibility to meet their needs as they see fit. Relatedly, California recently launched the nation’s largest children’s savings account, the CalKIDS program. A similar savings program for survivors would help them accrue savings beyond the average of $10.

We have learned from survivors what is needed to support their financial security. Governments at all levels, businesses, financial institutions, and every community can be a part of the solution—and so can you.

Sabrina Hamm is the Director of State Policy and Advocacy at FreeFrom, a national nonprofit working to create pathways to financial security and long-term safety for survivors of gender-based violence. Learn more and get involved at FreeFrom.